Within the labyrinthine domain of asset management, where the pursuit of optimal returns is ceaselessly pursued, real estate emerges as a singular asset class, characteriSed by its multifaceted intricacies and latent potential.

However, despite its undeniable allure, real estate often remains an enigmatic puzzle for many asset management firms in Zimbabwe.

The prevalent fallacy that real estate investment can be approached with the same standardized methodologies as equities, bonds, or commodities is a misjudgement that can lead to squandered opportunities and suboptimal outcomes.

To genuinely unlock the manifold benefits of real estate investment, asset management enterprises in Zimbabwe must forge formidable partnerships with real estate virtuosos or cultivate profound in-house expertise.

In this exhaustive discourse, we delve into the profundities of real estate investment, extracting insights from both developed and emerging markets, to underscore the paramount importance of specialised knowledge in maximising investor returns.

At the onset, it is imperative to dispel the fallacy that real estate investment can be exhaustively comprehended through cursory assessments bereft of the discerning acumen of property connoisseurs.

Unlike conventional financial assets, real estate boasts distinctive characteristics moulded by an amalgam of factors such as locale, market dynamics, regulatory frameworks, and an array of socio-economic determinants.

The valuation of real estate assets necessitates a profound grasp of local market intricacies, spanning from the ebbs and flows of supply and demand dynamics to the labyrinthine web of zoning regulations, infrastructural advancements, and socio-economic nuances.

- Mavhunga puts DeMbare into Chibuku quarterfinals

- The brains behind Matavire’s immortalisation

- Bulls to charge into Zimbabwe gold stocks

- Ndiraya concerned as goals dry up

Keep Reading

Without such astute insights, asset managers perilously flirt with the perils of misinterpreting investment opportunities, potentially leading to misallocated capital and diminished returns for discerning investors.

To illustrate this contention, let us scrutinise the modus operandi of asset management behemoths in developed economies, where the integration of real estate expertise has metamorphosed into standardised practice.

In venerable markets such as the United States, Europe, and Asia, asset management luminaries acknowledge the specialised nature of real estate investment and proactively engage with dedicated real estate aficionados or entrench robust in-house real estate divisions.

These esteemed entities harness the acumen of real estate savants to orchestrate exhaustive due diligence, meticulously evaluate property performance, optimise portfolio allocation, and deftly navigate the labyrinthine legal and regulatory frameworks.

The upshot is a meticulously nuanced and well-informed approach to real estate investment, often culminating in superlative risk-adjusted returns for astute investors.

Similarly, in burgeoning economies, the significance of real estate expertise is increasingly underscored as urbanisation burgeons and infrastructure development reaches unprecedented crescendos.

Take, for instance, the illustrious case of China, where asset management juggernauts have embraced real estate investment as the fulcrum of their investment strategies.

By forging symbiotic alliances with indigenous real estate magnates and harnessing specialized cognisance of the Chinese market, these visionary entities have capitalised on the nation’s urbanization phenomenon, delivering outsized returns to discerning investors.

Moreover, in markets as diverse as Brazil, India, and South Africa, asset management luminaries have erected dedicated real estate investment trusts (REITs) to proffer investors exposure to burgeoning property markets, while adeptly tapping into indigenous expertise to navigate idiosyncratic market dynamics.

In the context of Zimbabwe, where the real estate sector assumes a pivotal mantle within the economy’s fabric, the imperativeness for asset managers to seamlessly integrate real estate expertise assumes gargantuan proportions.

With a burgeoning urban populace, a burgeoning middle class, and an escalating demand for commercial and residential properties, Zimbabwe unfurls a veritable tapestry of opportunities for real estate investment.

However, the veritable fruition of these opportunities hinges precariously on a profound comprehension of local market dynamics, regulatory frameworks, and the mercurial ebbs and flows of socio-economic paradigms.

Furthermore, the innate complexities entrenched within the Zimbabwean real estate market, ranging from labyrinthine land tenure issues to regulatory vagaries and currency vicissitudes, accentuate the quintessential need for specialized expertise.

Asset management juggernauts that remain oblivious to these subtleties imperil investors by exposing them to gratuitous risks and foregone opportunities.

Conversely, firms that elevate real estate expertise to a zenithally pedestal unlock a pantheon of unique investment opportunities, optimize portfolio performance, and augur enduring value for discerning investors.

To further underscore the indispensability of real estate expertise, let us conjure a pedagogical parable wherein two asset management titans in Zimbabwe encounter a beguiling commercial property investment opportunity.

The first entity, bereft of specialised real estate acumen, conducts a perfunctory appraisal predicated on generic financial metrics and cursory market trends. Conversely, the second entity, armed with erudite real estate savants, undertakes a holistic analysis, delving deep into factors such as location salience, tenant demography, lease intricacies, and potential value augmentation avenues.

Owing to their specialised acumen, the latter entity discerns latent value embedded within the property opportunity, negotiates propitious terms, and orchestrates a value-amplification stratagem to exquisitely maximise returns.

Over temporal horizons, the property metamorphoses into a fount of steady rental revenues, capital appreciation, and portfolio diversification accolades for discerning investors.

Meanwhile, the former entity, ensnared by the quagmire of its dearth of real estate expertise, overlooks pivotal nuances, thereby relegating itself to the annals of suboptimal investment decisions and lacklustre performance vis-à-vis the overarching market trajectory.

To maximise returns and minimise risks, asset management firms in Zimbabwe must take deliberate steps to integrate real estate expertise into their investment processes. This integration can take several forms:

Strategic partnerships: Asset managers can partner with reputable real estate firms that have established track records in the local market. These partnerships allow asset managers to tap into specialised knowledge and gain insights into market trends, regulatory changes, and emerging opportunities.

In-house expertise: Building a team of experienced real estate professionals within the asset management firm can offer a more consistent and dedicated approach to real estate investment. These experts can conduct detailed property evaluations, devise investment strategies, and manage the ongoing performance of real estate assets.

Dedicated real estate investment divisions: Establishing a dedicated division focused on real estate investment ensures that asset management firms have the resources and focus to maximise returns from this asset class. This approach also facilitates deeper engagement with the local community and regulatory bodies.

Beyond these strategies, asset management firms should also invest in ongoing education and training to stay ahead of market trends and evolving regulatory landscapes. Real estate is a dynamic sector, and maintaining a high level of expertise requires continuous learning and adaptation.

Furthermore, asset management entities should prioritise technological integration, leveraging advanced analytics and artificial intelligence to enhance decision-making processes and identify emerging market trends.

By embracing innovation, asset managers can augment their competitive edge and deliver superior outcomes for their clientele.

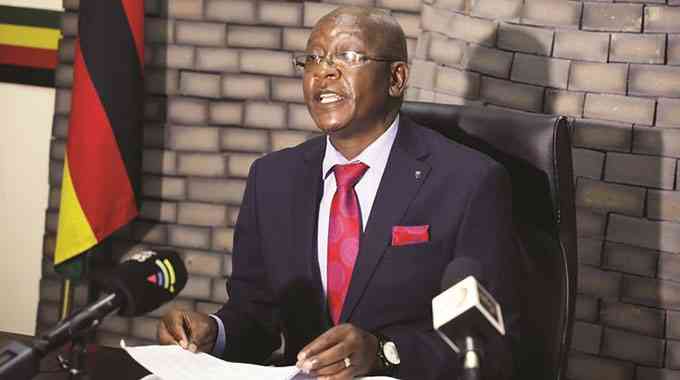

- Dr Bekithemba Mpofu is the chief real estate officer at Integrated Properties