Tafara Mtutu THE Reserve Bank of Zimbabwe released the modalities of purchasing the gold coins, nicknamed the Mosi-oa-Tunya Gold Coin, and a key highlight was the ability to purchase the coins in Zimbabwean dollars.

The weight of each coin will be one troy ounce, with a purity of 22 carats. Each coin will have a serial number, and buyers of the first couple of coins to be sold will take physical possession of the coin and receive a bearer ownership certificate.

The coins will liquid asset status, which means they will be easily converted to cash. They will also be tradable both locally and in international markets.

In addition, the coins will have prescribed asset status, and offers institutional investors an opportunity to meet regulatory requirements for prescribed asset investments. Buyers of these coins can use them as security for loans and credit facilities.

The announcement further stipulates that the gold coins will be available for sale to the public from July 25, 2022 in both local currency (ZW$), United States dollars (USD), and other foreign currencies at a price based on the prevailing international price of gold and the cost of production.

The coins will be sold through the central bank and its subsidiaries (Fidelity Refiners and Refiners and Aurex), local banks and selected international banking partners. Entities selling the coins shall be required to apply Know Your Customer (KYC) principles.

The coins widen the country’s capital market with a new asset class — gold — which underpins the anticipated strong demand for the coin. Bullion coins date back as far as 1970 with the issuance of South Africa’s Krugerrand.

Other notable gold coins in issue since the Krugerrand include Canada’s Maple Leaf, Mexico’s Libertad, China’s Panda, US’ American Eagle, Australia’s Kangaroo, and the UK’s Britannia.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Asset managers, pension funds, and insurers have been at the forefront of the lobbying efforts to increase asset classes beyond treasuries, stocks, and private equity since 2019, and we think that these coins are a step forward towards addressing this concern.

Further, we opine that these entities will likely liquidate their ZW$ holdings on the stock market to fund the purchase of these coins. We also expect holders of nostro balances to liquidate their balances in a manifestation of the “bird-in-hand” phenomenon.

Given the volatile policies in the country and abrupt changes in the value of balances in banks in 2019, we assert that there is more confidence in gold’s ability to store value than in foreign currency nostro accounts.

We also opine that, despite efforts to uniquely identify the coins and establish due diligence protocols, there will likely be arbitrage profiteering opportunities using the gold coin and the stock market. The ability to sell the coin in international market potentially opens the country to a withdrawal of foreign currency in the formal market and even more so, withdrawal of ZW$ liquidity in the country.

While this could theoretically put downward pressure on the parallel market rate, we maintain that there remain other factors nullifying the intended effect.

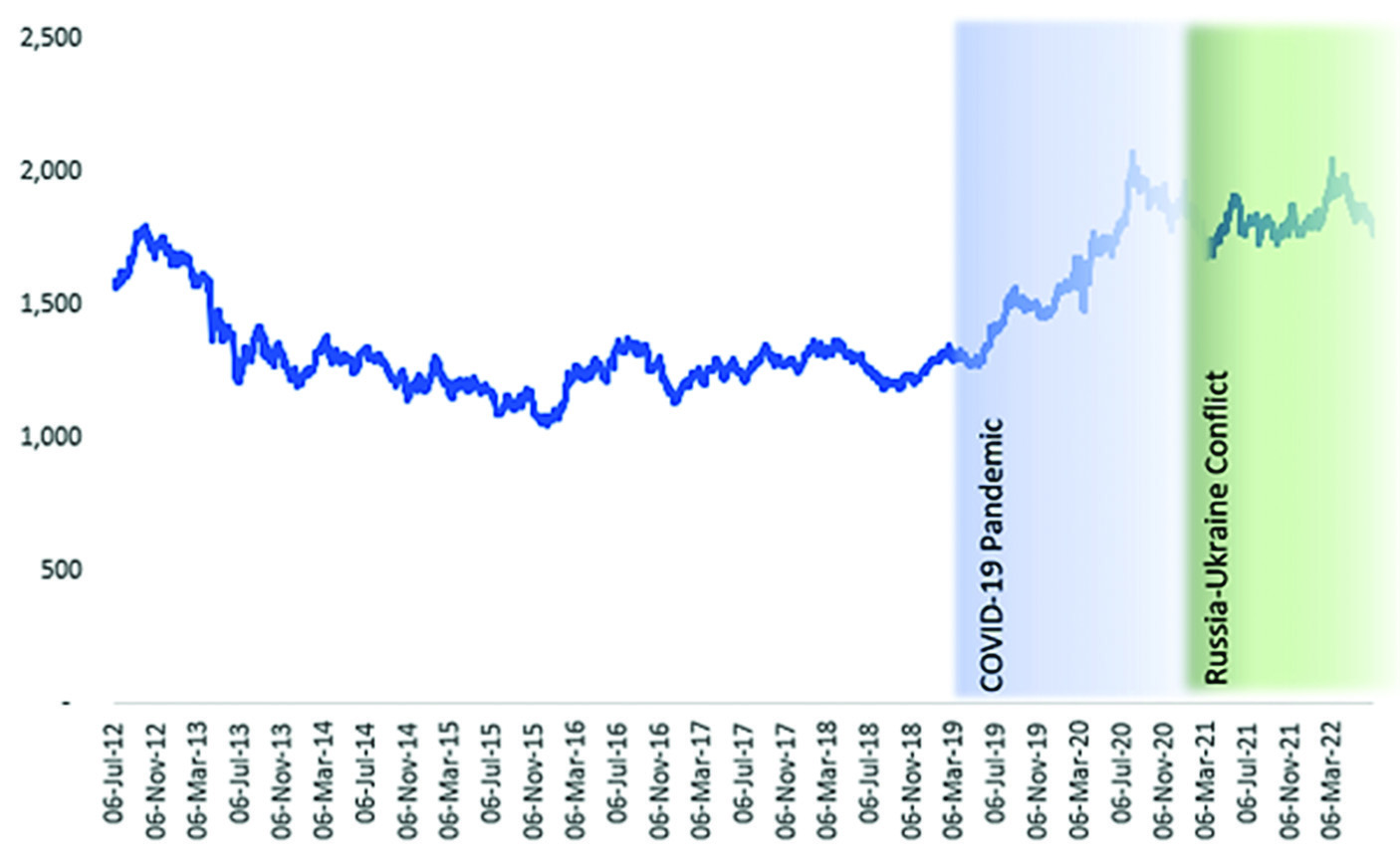

Some have asked whether this is the right time for investors to buy the coin and the short answer is no. Over the past four years, the current international price of gold has been supported by the Covid-19 pandemic and the Russia-Ukraine conflict.

In the absence of these global crises, we opine that the gold price would hover below US$1,400/oz. Hence, we opine that there is notable downside potential for fundamental investors.

However, we reiterate that demand will be firm because of an overarching need to diversify investments and liquidate nostro balances.

The sustainability of the modalities surrounding the trading of this coin hinges on the payment modalities to artisanal gold miners. Gold deliveries in Zimbabwe have significantly recovered because of the appetising USD payments to artisanal miners.

However, should there be a disparity between the amount of USD used to purchase the gold from artisanal miners and the USD used to pay for the coins, this could squeeze the central bank and its intermediaries’ foreign currency reserves. If this ripples to the modalities to artisanal gold miners, this could result in low gold deliveries to Fidelity Printers and increased gold smuggling activity.

We opine that in the short-term, there will be a withdrawal of liquidity from the stock market, mostly from blue chip stocks that institutional investors are concentrated in. As a result, stock prices will likely remain subdued.

As it stands, several stocks on the ZSE look undervalued in USD values, whether one uses the official currency rate or the parallel market rate, and we recommend long-term investors use this opportunity to buy blue chips such as Delta, Econet, Innscor, OK Zimbabwe, Meikles, and Hippo until the stock market recovers.

- Mtutu is a research analyst at Morgan & Co. — tafara@morganzim.com or +263 774 795 854.