On June 22, 2023, the African Continental Free Trade Area (AfCFTA) Advisory Council (AAC) in Zimbabwe will host a High-Level Dialogue on Zimbabwe.

The vision is earmarked on catalyzing collaboration amongst industries in Zimbabwe to take advantage of opportunities brought about by the African Continental Free Trade Area (AfCFTA) agreement.

The AfCFTA is one of the world’s largest free trade areas, bringing together the 55 countries of the African Union (AU) and eight (8) Regional Economic Communities (RECs).

The agreement is set to spur intra-African trade while increasing the appeal of direct investment in Africa.

The World Bank estimates that the trade pact could boost regional income by 7% or USD450bn, speed up wage growth and lift over 30 million people out of extreme poverty by 2035.

The main advantage is that there will be an increase in the demand for financial services such as banking, payments, and insurance.Piggy believes that there is a need for innovation on the part of industry players to support service needs that will emerge from AfCFTA.

A key objective of the AfCFTA pact is to promote industrial development through diversification.

An important area has to do with services. While the level of trade in services remains low in Africa, the service sector in Africa is very important given that it can account for over 50% of GDP in many countries.

- Delays in ratifying AU human rights charter disconcerting

- Cartoon: September 27, 2022 edition.

- Feature: Zim needs to shift its trade matrix

- AfCFTA: What is in it for Zimbabwean businesses?

Keep Reading

Categories include business services, communication services (including audio-visual services) and financial services (Banking and Insurance).

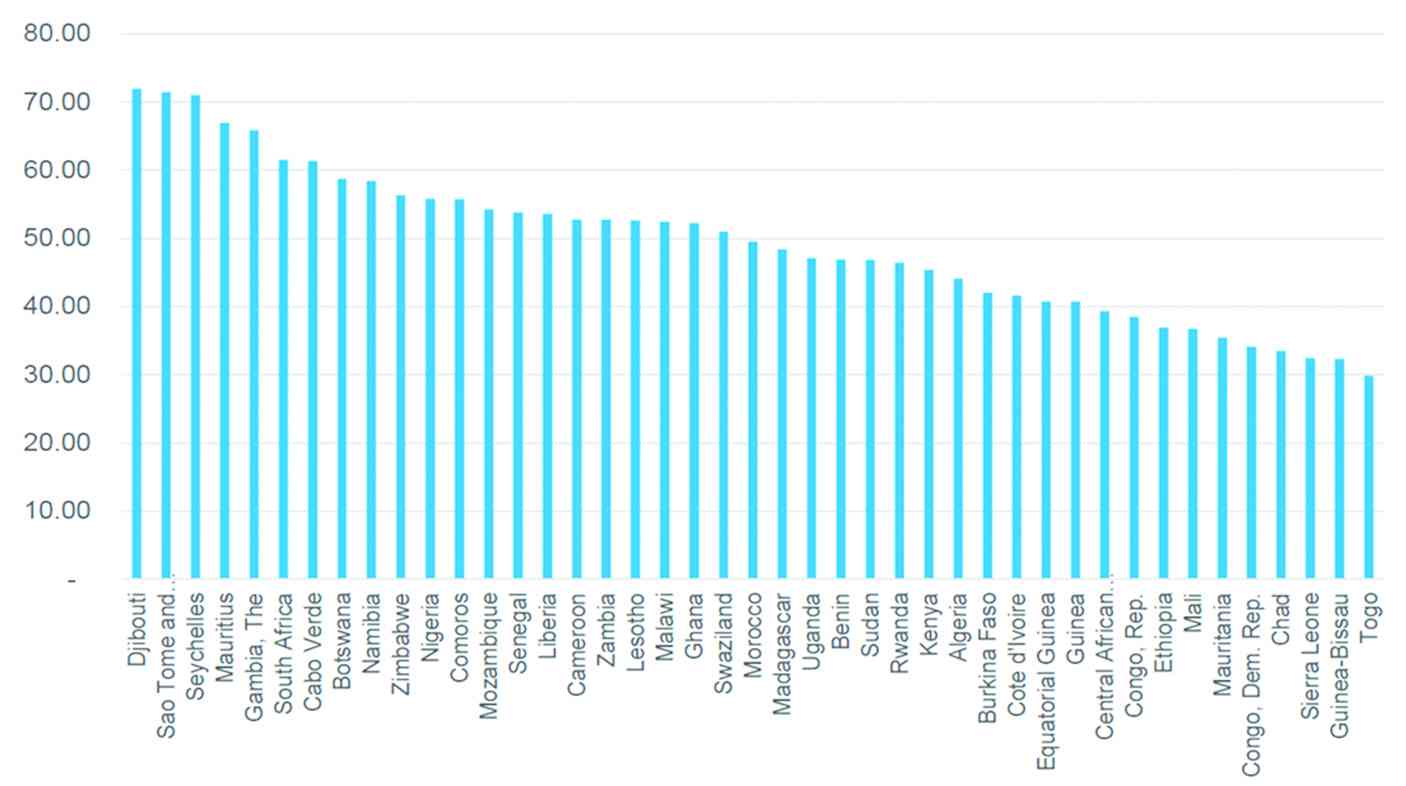

As illustrated in the info-graph, the services sector represents at least 50% of GDP in many African countries (average 53.2% in Sub-Saharan Africa), and more than 70% in some economies such as Seychelles, Sao Tome and Principe and Djibouti. The World Bank Group notes that in Africa,

while agriculture’s share of GDP has declined and manufacturing has stagnated, services (including insurance) are increasing as a share of total employment and GDP, driving value addition, and providing critical inputs to boost other economic activities. By comparison with other countries, the value of global services exports of Egypt (Africa’s largest exporter of services) is still insignificant when compared with the value of trade in services by leading developed and developing countries.

This means there is huge scope for intra-African trade in services. The trade pact would change the African financial services land scape through;

Increased access to various industries and geographies for financial services players;

Financial services players would have to invest in innovation and technology to cater for the cross-border payment systems;

Financial services players would also have to explore regional value-chains; and

The need for active participation by financial services players in the ongoing negotiations on investment laws, competition, and trading terms between African countries.

In conclusion, the AfCFTA aims to connect 1.3 billion people across 55 countries with a combined gross domestic product (GDP) valued at USD3.4 trillion.

Beyond its ground-breaking size, the AfCFTA signals a paradigm shift and a commitment to deeper integration of the continent by negotiating goods and services concurrently.

It is thus hailed as an economic game-changer for Africa’s development owing to its potential to boost intra-African trade but also to provide an opportunity for countries in the region to competitively integrate into the global economy, reduce poverty, and promote inclusion.

It is against this background that financial services players in Zimbabwe are being encouraged to actively participate in the ongoing AfCFTA negotiations on investment, competition, and trading arrangements.

Get more insights on AfCFTA opportunities by joining a PiggyBankAdvisor WhatsApp Group (+263 78 358 4745).

- Matsika is the managing partner at Mark & Associates Consulting Group and founder of piggybankadvisor.com. — [email protected]/[email protected].