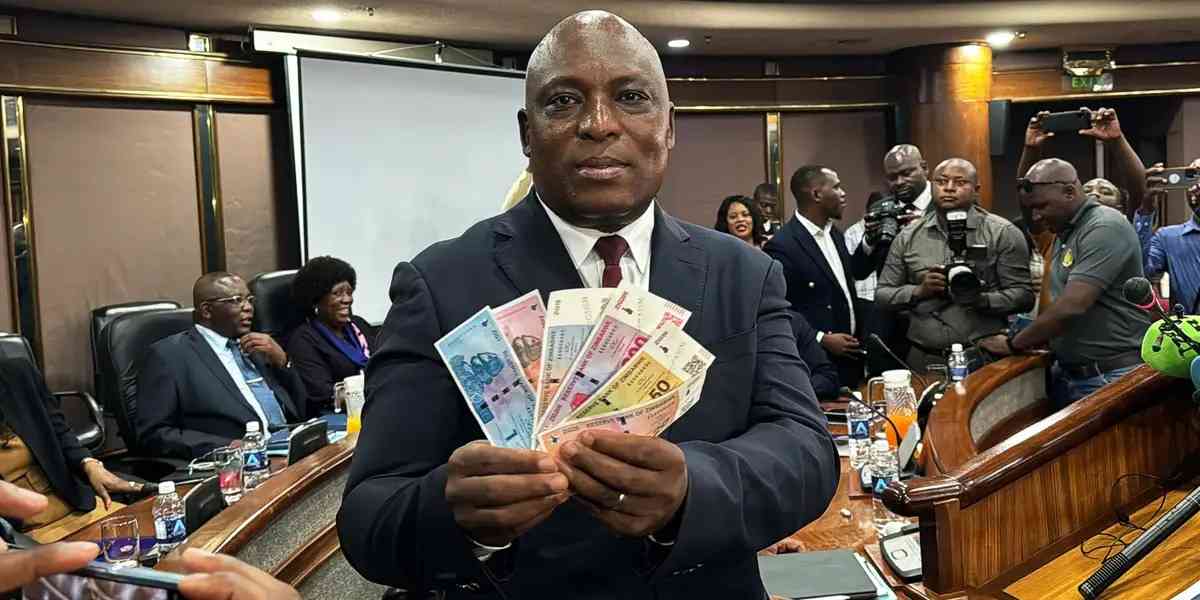

The Zimdollar is currently navigating a very turbulent path and the relative stability enjoyed for the greater part of the second half of 2022, has all been lost. as in prior year, we have warned that business need not be blinkered by relative stability, which at most was very temporary given the means out which it was achieved.

A raft of both fiscal and monetary policy measures were put in place to mop up excess liquidity and tighten financial and capital markets controls resulting a fairly stable outturn for the Zimdollar.

Measures such as gold coins, although wildly popular and rationale from the perspective of investors or those seeking to basically preserve value, are clearly stop gap and cannot sustainably relied on to curb spikes in inflation and currency depreciation.

The same goes for government securities such as bonds and treasury bills. These are largely stop gap policy tools, which can cool off economies over the short term and has payoff which if not countered by solid fiscal reconfigurations can lead to drastic economic implosion.

The end the question always boils down to the reasons why these tools are used in the first place. These measures are invoked as a way of cooling off an overheating economy to lower inflation spikes and exchange rate depreciations. This means the underlying problems is inflation spikes and exchange rate depreciation. In turn, these underlying challenges, in the case of Zimbabwe, can only be traced back to new money injection and creation which are largely to feed an insatiable appetite for spend. Official data has shown that Zimbabwe’s government has largely lived within its budget for the greater part of the last 5 years, which would imply low reliance on borrowing and money printing.

However, along the way there were spikes in money supply, suggesting overspending among other catalytic factors.

2023 is proving to be an overdrive of the overspending spree. The current levels of overspending were last seen in 2018, the year in which the 1:1 rate between wired RTGS and real USD ended. In the respective year TBs of over US$2 billion were issued and these were not meant to sterilise money supply, rather they were redirected towards massive government expenditure resulting in credit creation on the wire and the demise of the unsustainable 1:1 pretense.

In 2023, government has already issued TBs which are just shy of US$2 billion and these are mainly going to forgone expenditure. The impact of the move, is to massively drive the exchange rate southward.

- Mayhem as schools reject Zimdollar fees

- Forex demand continues to fall

- USD fees: Govt policy failure hurting parents

- Prices continue to skyrocket

Keep Reading

In depth, we looked at the matter in a weekly issue of The Axis, and projected a massive depreciation of the local currency. At that point the parallel rate was sitting at 1:1100 against the USD and is now at 1:1600, a 45% depreciation, under 2 weeks. as an implication the parallel rate premium is now at 65% to the official rate and this has adverse ramifications cannot be overstated. it creates massive room for rent seeking and heightens speculative borrowing which in turn drives Zimdollar liquidity further up. In the week under review, the Zimdollar pared 1.44%, increasing the pace of losses from last week, but however remaining the below the psychological 1:1000 mark. A total of US$20.1 million was traded in the week under review, which compares favourably to a year to date average of US$17 million, a week.

Going forward we are of the view that the Zimdollar will remain on pedestal, tumbling against the US dollar.

We view the move to effect a 40% salary increase for the civil service as having a catalytic effect to the unfolding currency battering, in action. We had foreseen government ramping up expenditure in an election year but the extend of the impact is yet to be fully ascertained. In the interim it is advised to tame back on significant Zimdollar exposure and to deepen USD generation. Production and retailing companies do better in the environment by increasing stock levels, while closely monitoring working capital positions and needs.

Preffering USD debt for ZWL, can also reduce interest costs and help maximise profitability. While it is easy to recommend increasing exposure in hard assets, the mid to long term impact is a less liquid balance sheet and high exposure to assets which cannot be easily converted into liquid cash. The beauty of it is that the change in the environment and legislation, where a number of USD denominated investment assets have been development, allows for alternative investments into these asset class. These could be REITS on the VFEX, gold coins, USD denominated bonds and related investments. Cost management should also remain a priority across board.

- Gwenzi is a financial analyst and MD of Equity Axis, a financial media firm offering business intelligence, economic and equity research. — [email protected]