THE Zimbabwe dollar lost 84,1% of its value compared to the United States Dollar (USD) between December 2021 and December 2022, as hyperinflation took a toll on the local currency.

Data gathered by the Zimbabwe Coalition on Debt and Development (Zimcodd) show that from US$1:ZWL$108,67 in December 2021 to US$1:ZWL$684,33 in December 2022, the local currency lost nearly 84,1% of its value versus the USD.

The Zimbabwe dollar is currently trading at ZWL$779:US$1.

"Consequently, price inflation spiked, in annual terms, during the same period from 60,7% to 243,8%. Granular analysis shows that apart from the unsustainable monetary aggregates, price inflation in 2022 also emanated from the poor 2021/22 cropping season and the ripple effects of the Russia-Ukraine war," the Zimcodd report noted.

A 2022 World Bank (WB) report shows that at 353%, Zimbabwe had the highest food inflation globally.

Also, the WB estimated that about 40% of Zimbabweans were living in extreme poverty in 2022 as disposable incomes were decimated by ravaging inflation and income disparities magnified by a tattering currency.

"After a brief moderation of Zimbabwe dollar decline in the parallel markets and inflation growth between July-October 2022, the trend reversed course starting in November 2022 likely because of elevated government spending associated with fourth quarter bonus payments and agriculture support as well as increased general demand," the report noted.

The local unit slid from ZWL$800 in October to close December at ZWL$900 against the USD on the parallel market.

- To or not to deduct Aids Levy from VAT in Zim

- Charging school fees in forex unreasonable

- Stop meddling in PSMAS affairs

- Village Rhapsody: Zimbabwe’s currency merry-go – round continues

Keep Reading

"In the same vein, monthly prices upscaled by 0,6 percentage points to close 2022 at 2,4% from 1,8% recorded in November. With so many risks to the 2023 economic outlook such as a high perceived corruption, general election, unpredictable path of the Covid-19 pandemic, and unending Russia-Ukraine war, Zimbabwe will likely continue being trapped in vicious cycles of currency and price volatilities," the report further noted.

Zimbabwe suffered the highest levels of hyperinflation ever recorded for a nation in peacetime in 2007 and 2008.

The native currency was officially abandoned by the government in 2009 after experiencing market rejection as traders began to prefer dealing in other currencies, particularly the US dollar and the South African Rand, signalling the commencement of the dollarisation revolution.

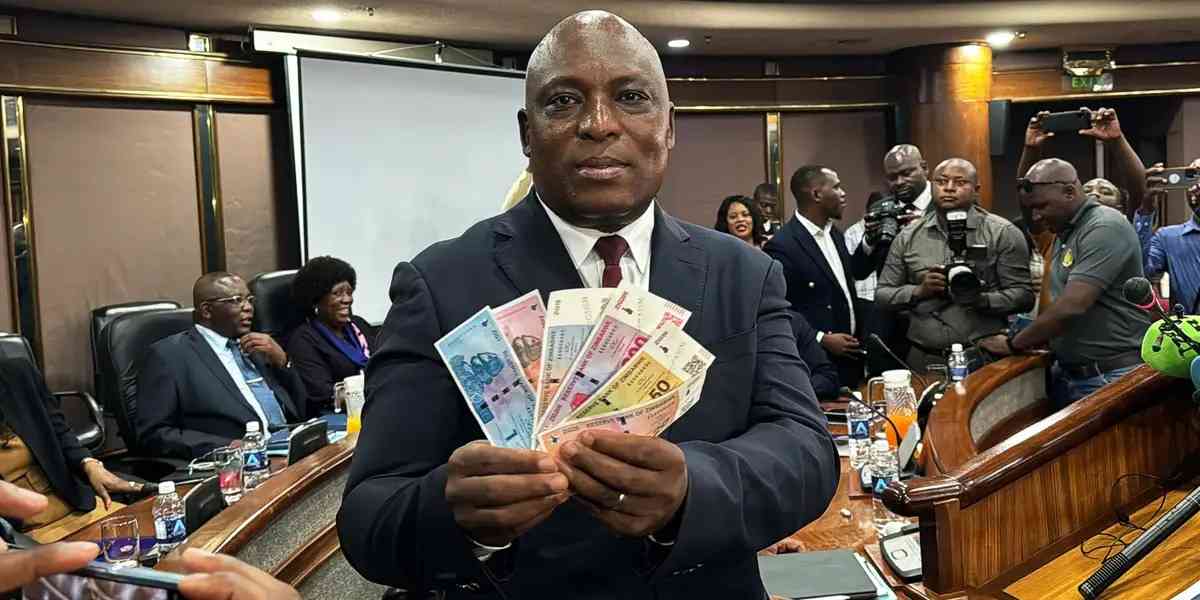

After 10 years, the local currency was rebranded in 2019 as part of the government's austerity measures and currency reforms. This was accomplished through Statutory Instrument 33 (SI33), which established the Real Transfer Gross Settlement (RTGS) dollar, which consists of all in-use bond notes and coins, mobile money, and bank balances.

The local currency was trading at $2,50 to the US unit on the first day of trading in the official interbank market before shockingly dropping 62% of its value in just four months to conclude June 2019 at $6,60 to the greenback ($8,50 in alternative markets).

"It was, however, astonishing at the time that authorities forged ahead with forced de-dollarisation despite the existence of a huge body of knowledge showing that successful de-dollarisation only comes when undertaken as a process, not an overnight event," the report noted.