If Western business archetypes such as sole trader, private company, partnership, joint ventures, cooperatives and others were sustainable, most African economies would be vibrant. The reality on the ground suggests most of these types of businesses are inapplicable to the African context as shown by the rate of business and economic collapse compared to successful cases.

Although private investment is being touted as a solution to African development, very few private companies want to work with the majority of people at the bottom of the income pyramid. On the other hand, cooperative principles are in many ways not in line with profit-making entrepreneurship but more to do with working together. Evidence indicates building long term business relations, which are absent in cooperatives, can only happen in mass food markets where relationships and trust are the foundation of strong business synergies. Sole trading is far from being a reality given that most African businesses are family businesses in which one cannot thrive as an individual or sole trader.

Mass food markets as foundation

If identity is very important in business, mass food markets are the foundation of businesses that express an African identity. As business ecosystems, African mass food markets are characterised by a lot of undocumented synergies and business models that are largely invisible from outside but obvious to those inside. Most of the business models begin as soon as food commodities get into the market. This is when distribution systems reveal types of relationships and business archetypes or models between commodity suppliers and market actors like vendors and transporters.

As soon as the market starts playing its distribution role, new sets of relationships and business models emerge such as those comprising individual customers, formal small-and-medium enterprises (SMEs) who use vehicles to carry food as well as vendors linked to push carters. The pricing of services offered by push carters is agreed upon collaboratively different from comparisons used in fares charged by transporters who bring food from farming areas. Push carters charging vendors for moving food from the market to waiting transport consider a number of factors based on distance to the waiting vehicles and volume of commodities carried on a push cart in one load. Some vendors may have fewer commodities but travel the same distance like those with bulky commodities. Another key business model is around loading and off-loading food with charges for such services reached by consensus.

Adaptation of Western business

While African business archetypes have not been documented, they have adapted some elements of Western business models. For instance, traders can work cooperatively to procure commodities from farming areas and co-share dividends after selling the commodities. That relationship can be rather opportunistic than permanent. Brief partnerships are also common where traders specialising in the same commodities like potatoes can partner for purposes of sharing skills in marketing efficiently and quickly.

Where it seems traders are operating as sole traders, they will not really be working in isolation because there are invisible components of partnership between individual traders who go to buy commodities together from farming areas. Only the profit-motive makes the traders private entities, otherwise they do not see themselves as sole traders.

- Renault hands Russian assets to Moscow

- New perspectives: Building capacity of agricultural players in Zim

- Letter from America: The death of the Zimbabwe dollar shows the King has no clothes

- Deputy minister in GMB theft scandal

Keep Reading

What seems clear is that no single business archetype can thrive on its own because contexts are always changing. You can be a sole trader but need to pool resources with others in order to buy in bulk. Guaranteeing each other in order to access loans implies a sole trader needs others. By guaranteeing each other to get a loan, traders will be like seeding their businesses against a loan.

Elements of different business archetypes are applied in different circumstances, based on relationships and trust as key ingredients. One trader can go to the field to negotiate with farmers while the other remains on the market to monitor stocks and organise transport. Commodities also move between short value chains based on trust from truck to the market, from farmer to trader to bulk purchaser and the payment goes back to the farmer. Most enterprises in markets are linked to families and communities and all these invisible models are undocumented.

How can you formalise ?

While African governments have been talking about the importance of formalising the informal sector including mass food markets, failure to understand ecosystems, operations and dynamics in informal set-ups and markets have been major barriers. Formalisation has to be informed by existing ecosystems, their operations and dynamics. It cannot be one-size-fits-all because traders specialising in clothes are different from those into buying and selling food. Some of the invisible trends worth understanding include relationships between traders, suppliers, customers and others.

Policy makers have to find answers to questions like: What is the entry point for formalisation? Do you start at vendor level or at trader level or at sales agent level? In African mass food markets, a sales agent can develop a good relationship with customers and hire push-carts and earn more than a stall owner.

Do you formalise the owner of the push carts or the sales agent who hires a push-cart? In mass food markets the same mode of transport is always on the road but people are exchanging hands in ways that outsiders like policy makers may not be able to see or understand.

It is unfortunate that in most developing countries formalisation is just about paperwork for the purposes of collecting tax, with no policy interest to improve the way informal business operates. Informality has a stigma in that it is associated with illegality. On the other hand, formalisation is tantamount to witch-hunting rather than packaging and marketing home-grown enterprises in positive ways. Just like formal supply chains, informal supply chains have lots of knowledge, data, information critical for driving business and agriculture sector growth. Traders have more street wisdom and knowledge than university graduates, MBAs and policy makers.

Every actor has a role

Every actor in the market has a role and its key for policymakers to understand those roles before prescribing wholesale formalisation. Push carters and those who specialise in packaging are not recognised. The same applies to caterers who provide food as well as those who provide air time for communication. Other actors play the role of banks and money lenders who provide demanded services.

They may be charging high interest but that interest is offset by the convenience of their services compared to formal financial institutions. For some traders, it is convenient to get a loan at a higher charge immediately than applying for a loan from a bank but remain uncertain when the money will come.

Without deep research, it is impossible for policymakers to understand mass food markets, their dynamics and how they interface with formal monetary policies. If food accounts for more than 60% of investment, policy makers should strive to understand how the Return on Investment (ROI) is being matched with the demand side. For instance, it is through fluid research that policymakers can see how tomatoes have a huge impact on household budgets. Households may be shifting budgets from fruits to tomatoes due to an increase in the price of tomato which is a necessity that pushes other commodities like fruits into luxuries, yet fruits are critical for a balanced nutrition. Necessities tend to change one commodity from being a necessity to a luxury whose demand ends up decreasing. These kinds of relationships are often not visible to policymakers.

Appreciating middlemen

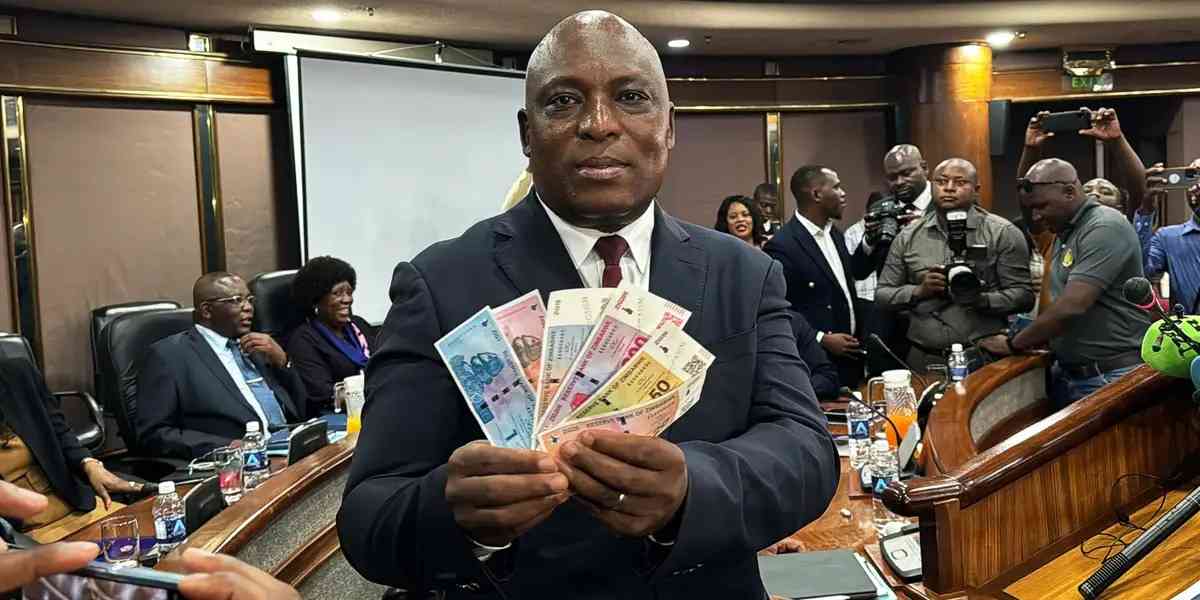

As long as policy makers do not understand the problems being solved by middlemen, they will continue to misunderstand the role of these key actors in African markets and food systems. The reality is that mass markets cannot run businesses entirely between farmers and end users or consumers. Middlemen are a key player especially if farmers are selling slow movers like grains where a farmer may not be able to sell a tonne of small grains at once. Unless they are selling to parastatals like the Grain Marketing Board, which unfortunately have a reputation for not paying on time, farmers need someone who risks his/her money to take the commodity and tie his /her money and sell slowly while absorbing risks associated with storage while waiting for consumers to buy.

Another dynamic is that it is often not possible for all consumers to buy directly from farmers because consumers come at different times and farmers also bring commodities at different times as dictated by production cycles. Farmers under emergency situations should be able to sell whether the market is closed or not. That role is often fulfilled by the middlemen in mass markets.

Supermarkets buy from farmers and sell to consumers who cannot go directly to farmers. Wholesalers contract farmers for export. All these are different types of middlemen but that name is not used to describe them. Understanding why middlemen exist in ecosystems is key to identifying the hurdles that must be overcome for all actors to experience ease of doing business.

In the absence of evidence, African policymakers have no clue how much money is circulating within mass markets as well as the role played by the mass food market in managing inflation, building urban resilience, contributing to rural developments and sustaining food systems.

A culture of data collection and tracking the movement of food will eventually ensure mass food markets and smallholders are rewarded for contributing to socioeconomic stability and averting political upheaval that would cost African governments billions of dollars.

- Dhewa is an independent researcher on food markets. — [email protected]