LORRAINE NDEBELE ALLIED Timbers Zimbabwe (ATZ) is eyeing a regional footprint as it seeks to expand its markets beyond Zimbabwe.

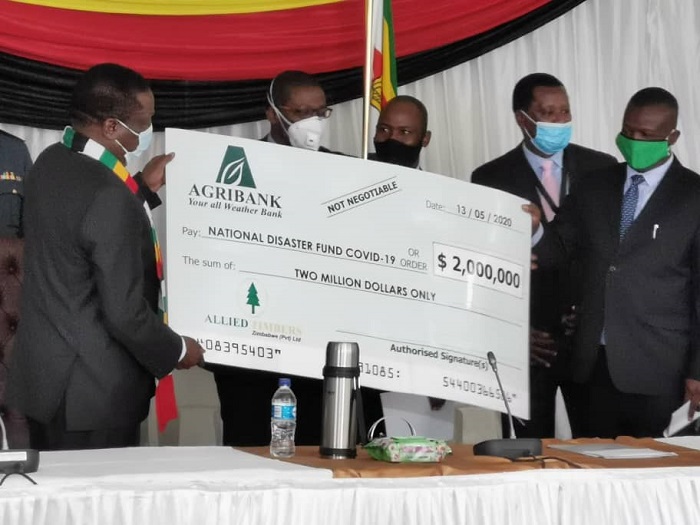

The company declared a dividend to the government packaged as ZW$10 million (US$38 700) and US$50 000.

According to the state-owned company’s annual report for 2020, presented during an annual general meeting this week, the company is targeting a number of opportunities locally and regionally.

“The group is exploring opportunities to expand its operations organically both in the local and regional markets. We will continue to invest in our people, upgrading our infrastructure, investing in our manufacturing plants, market presence, developing our technology platforms and leveraging on our local and international partnerships,” Allied Timbers’ chief executive officer Remigio Nenzou said.

In its financials, the group recorded an operating profit of ZW$7,731 billion (US$30 million) recording an increase of 302% from the ZW$1,924 billion (US$7,4 million) in the previous year.Company chairman Itai Ndudzo declared the dividend to Environment, Tourism and Hospitality ministry permanent secretary Munesu Munodawafa during the firm’s AGM in the capital this week.

The company also announced that the increase in operating profits was largely due to the fair value movement of biological assets.

Nenzou said the company would continue to transform to ensure value and growth are delivered to stakeholders.

The group’s cost of production and overhead expenses during the period under review also continued to increase as suppliers and service providers adjusted prices in line with the devaluing local currency.

- Chamisa under fire over US$120K donation

- Mavhunga puts DeMbare into Chibuku quarterfinals

- Pension funds bet on Cabora Bassa oilfields

- Councils defy govt fire tender directive

Keep Reading

Inflation adjusted revenue for the period increased 144% to ZW$1,677 billion (US$6,4 million) in 2020 compared to ZW$688 million (US$26 million) achieved in 2019.

Nenzou added that periodic price adjustments were done in line with increases in production costs to sustain revenue growth and protect margins.

“The group continues to generate positive cash flows which have been utilised to fund operations, and capital investments as well as investing in productive capital assets which enhance efficiencies in the business,” he said.

On operations, Nenzou said occupation of the group’s plantation forests by illegal settlers continues with approximately 14 000 hectares having been affected.

“The company is following legal processes, and liaising with the central government in an effort to address this matter,” he added.

The company’s total sawmills production volume for the year increased 121% to 99 421 square metres up from prior year production of 44 928 square metres.

The production was, however, affected by incessant breakdowns which disrupted the production flow. Truss production decreased from 568 square metres to 558 square metres mainly affected by inadequate supplies of strength graded timber to truss plants due to increased competing needs. Allied Timbers has also embarked on an ICT project upgrade with a view of automating the business processes.

“It is our belief that we will be able to run efficiently, effectively and online and thereby reducing the cost of doing business, and addressing some of the internal control weaknesses”, Nenzou said while noting the effects of the global Covid-19 pandemic which had a significant impact on the group. Going forward the company’s focus is to remain focused on increasing the contribution of export sales to support the group’s retooling programmes.